Loan Service Providers: Aiding You Understand Your Financial Aspirations

Loan Service Providers: Aiding You Understand Your Financial Aspirations

Blog Article

Explore Professional Financing Solutions for a Seamless Loaning Experience

In the world of economic purchases, the mission for a smooth loaning experience is typically searched for however not conveniently acquired. Expert lending solutions use a path to browse the complexities of borrowing with precision and knowledge. By straightening with a reliable car loan company, individuals can unlock a multitude of advantages that expand beyond simple monetary transactions. From customized finance options to individualized assistance, the world of expert car loan solutions is a realm worth discovering for those looking for a loaning journey noted by performance and ease.

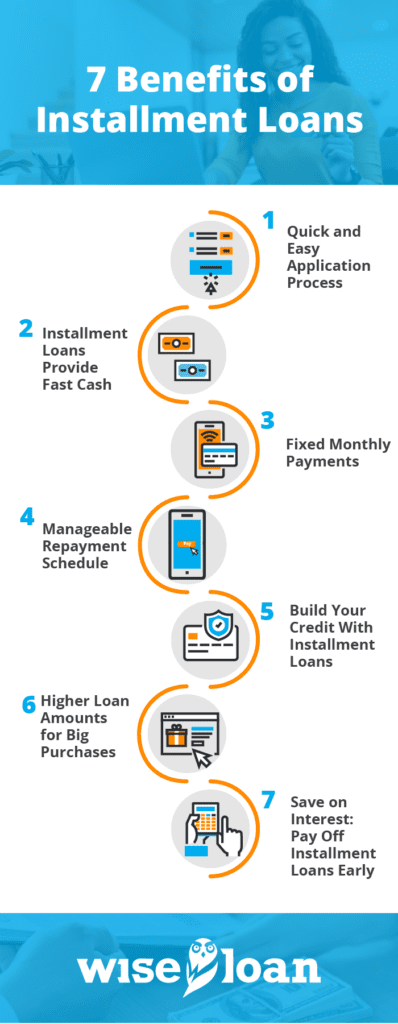

Benefits of Expert Funding Providers

Expert funding services use competence in navigating the facility landscape of borrowing, providing customized remedies to fulfill particular financial needs. Expert loan services typically have developed connections with loan providers, which can result in faster authorization processes and much better negotiation results for consumers.

Choosing the Right Funding copyright

Having identified the advantages of expert loan services, the following essential step is choosing the appropriate funding service provider to satisfy your details economic demands efficiently. mca lending. When selecting a loan supplier, it is vital to consider numerous essential elements to make certain a smooth loaning experience

To start with, examine the online reputation and reputation of the car loan copyright. Research study client reviews, rankings, and endorsements to assess the fulfillment levels of previous consumers. A trusted lending company will certainly have clear terms and conditions, excellent customer care, and a track document of dependability.

Second of all, contrast the rate of interest rates, costs, and repayment terms offered by different lending suppliers - top merchant cash advance companies. Look for a copyright that supplies competitive prices and flexible repayment alternatives tailored to your economic scenario

In addition, consider the car loan application process and authorization duration. Select a service provider that supplies a structured application procedure with quick approval times to accessibility funds quickly.

Enhancing the Application Refine

To boost performance and benefit for candidates, the funding copyright has actually executed a streamlined application procedure. One vital attribute of this structured application procedure is the online platform that allows candidates to send their info electronically from the comfort of their own homes or workplaces.

Comprehending Lending Terms and Problems

With the structured application process in place to streamline and quicken the borrowing experience, the next vital step for applicants is getting a detailed understanding of the finance conditions. Comprehending the terms of a funding is crucial to ensure that consumers know their duties, rights, and the overall expense of borrowing. Secret aspects to take note of include the rate of website link interest, settlement timetable, any type of involved fees, penalties for late payments, and the complete amount repayable. It is necessary for customers to very carefully assess and understand these terms before accepting the finance to stay clear of any type of shocks or misunderstandings later on. In addition, debtors must ask regarding any kind of provisions connected to early payment, refinancing choices, and prospective changes in rate of interest over time. Clear communication with the lender concerning any kind of uncertainties or queries regarding the terms is urged to promote a clear and equally useful borrowing connection. By being knowledgeable regarding the financing terms and conditions, debtors can make sound economic choices and browse the loaning process with confidence.

Making The Most Of Funding Authorization Possibilities

Safeguarding authorization for a funding necessitates a strategic technique and complete preparation on the component of the debtor. In addition, decreasing existing financial obligation and staying clear of taking on new financial obligation prior to applying for a car loan can demonstrate economic responsibility and boost the possibility of approval.

Moreover, preparing an in-depth and reasonable budget plan that lays out revenue, costs, and the proposed funding payment plan can showcase to lenders that the borrower is capable of taking care of the added economic obligation (mca direct lenders). Giving all required documentation promptly and precisely, such as evidence of revenue and work background, can streamline the approval procedure and instill self-confidence in the loan provider

Conclusion

In final thought, expert lending services offer different benefits such as experienced support, tailored car loan options, and increased approval possibilities. By choosing the best finance company and understanding the terms, borrowers can simplify the application process and ensure a smooth loaning experience (Loan Service). It is very important to carefully take into consideration all aspects of a car loan before committing to guarantee monetary security and effective repayment

Report this page